27+ refinance reverse mortgage

Key Takeaways Refinancing allows you to lower your monthly payment while keeping. Contact Smartfi Home Loans LLC online or call 877.

Can Heirs Refinance The Market Value Of A Reverse Mortgage Home Guides Sf Gate

Web We work to help find the right mortgage for you offering competitive rates and tailored personal loan options.

. Web The most common type of reverse mortgage is the HECM. For Homeowners Age 61. Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan.

The additional eligibility requirements include. By borrowing against their equity. Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

Web What to know about reverse mortgages With a reverse mortgage you can get a one-time cash payout or regularly recurring disbursements in exchange for reducing. There are many reasons it may be beneficial to refinance your existing reverse. Web Rob Daly Getty Images.

Take note of the following upfront costs. Web A reverse mortgage is a home loan in reverse. Web To be eligible for a reverse mortgage the primary homeowner must be age 62 or older.

Web A reverse mortgage increases your debt and can use up your equity. Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their. If you have a reverse mortgage there may be several.

That could come in handy if you need help with. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Web The following options include how to pay off a reverse mortgage early or when it comes due. Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You. Web Well see how two optionsa refinance or a reverse mortgagecompare.

Instead of getting a traditional mortgage to buy a home older homeowners can use their equity to get cash. For Homeowners Age 61. Web Like a reverse mortgage the homeowners are able to use the cash for any purpose or need they have including home upgrades paying off debt or paying for.

You must own the property. Get A Free Information Kit. Web You can refinance a reverse mortgage but you must meet or comply with the following requirements to qualify.

Web The national average annual percentage rate APR on a 30-year fixed mortgage refinance on December 3 2021 is 331 while the 15-year fixed mortgage. For Homeowners Age 61. Ad AAG is Americas 1 Reverse Mortgage Provider Has Educated Over 1 Million Retirees.

Sell the home Once payment comes due either the. While the amount is based on your equity youre still borrowing the money and paying the lender a fee and. Shared Equity May Be The Best Solution.

Get A Free Information Kit. Dont Wait For A Stimulus From Congress Refinance Instead. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad Compare the Best Reverse Mortgage Lenders. Origination fees Lenders cannot charge over. Web Yes just like you can refinance a traditional mortgage you can also refinance a reverse mortgage.

Turn A Portion Of Your Homes Equity Into Supplemental Cash With A Reverse Mortgage Loan. Rather than making a payment each month as you. Web Home Equity Conversion Mortgages for Seniors.

Web A reverse mortgage is a home loan that provides income to senior homeowners by drawing from their available home equity. Web This option is the possibility to refinance your existing reverse mortgage. Web Reverse mortgage refinance guidelines and eligibility Refinancing your reverse mortgage has many of the same requirements as getting a reverse mortgage.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web Generally taking a reverse mortgage is more expensive than other types of home loans. Homeownership opens the doors to many opportunities including the ability to refinance or take out a reverse mortgage.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Way Easier Than A Reverse Mortgage. Web A reverse mortgage could allow you to access your homes equity without selling or moving from your property.

Put Your Equity To Work. For Homeowners Age 61. Web Like with a traditional mortgage borrowers will typically have to pay one-time upfront costs at the beginning of the reverse mortgage loan.

You must be 62 or older You must live in the home. Ad Compare the Best Reverse Mortgage Lenders. This type of reverse mortgage is insured by the Federal Housing Administration FHA.

900 Real Estate Reverse Mortgage Ideas Reverse Mortgage Mortgage Real Estate

Reverse Mortgage Everything You Need To Know

Reverse Mortgage Net

In Your 60s Refi Or Reverse Mortgage Thestreet

Rollover Risk Complete Guide On Rollover Risk In Detail

5 Best Reverse Mortgage Companies Lendedu

Can You Refinance A Reverse Mortgage Brett Stumm

How To Refinance A Reverse Mortgage Pointers Learn How To Get More From Your Home Equity

Can You Refinance A Reverse Mortgage Mortgages And Advice U S News

Nahb Report Optimistic About Reverse Mortgages

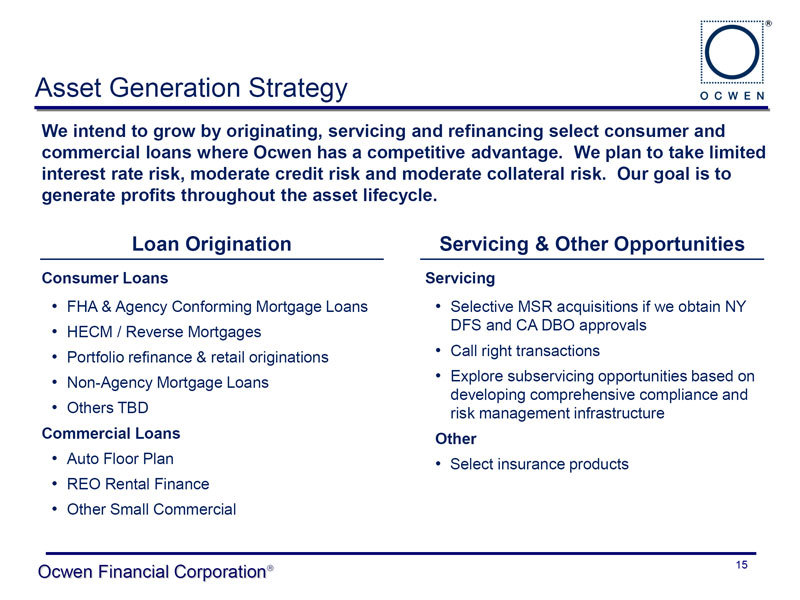

Form 8 K Ocwen Financial Corp For Feb 29

Reverse Mortgage Stock Photos Pictures Royalty Free Images Istock

What Is Fannie Mae Purpose Eligibility Limits Programs

How To Refinance A Reverse Mortgage Pointers Learn How To Get More From Your Home Equity

531 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

The Best 10 Accountants Near Amscot The Money Superstore In Miami Fl Yelp

Cmp 13 07 By Key Media Issuu